What is a carbon credit?

A carbon credit is a certificate or permit representing one tonne of carbon dioxide NOT EMITTED. Thus it also shows that its owner has the right to offset the emission of one tonne of carbon dioxide (or other greenhouse gases equivalent to one tonne of carbon dioxide) as the carbon credit stems from a project that has reduced global emissions of carbon dioxide or other greenhouse gases by one tonne.

A carbon credit is a certificate or permit representing one tonne of carbon dioxide NOT EMITTED. Thus it also shows that its owner has the right to offset the emission of one tonne of carbon dioxide (or other greenhouse gases equivalent to one tonne of carbon dioxide) as the carbon credit stems from a project that has reduced global emissions of carbon dioxide or other greenhouse gases by one tonne.

The negative effects of greenhouse gases emitted during the course of human activities significantly contribute to the effects of natural causes leading to global warming. The realization that, because of their global negative impact on the environment, it is both inescapable and urgent to mitigate the emission of GHGs, led to the creation of the carbon credit market. Today, carbon credits have become an instrument gaining more and more importance in the fight to reduce the amount of greenhouse gases emitted into the atmosphere.

The volume of carbon credit trade has shown a significant increase in recent years. This growth is so rapid that, according to some analysts, it may become the most popular market commodity for the next decade.

The History of Trading Carbon Credits – Compliance Market Carbon Credits:

Global greenhouse gas emissions were first regulated in the framework of the so-called Kyoto Protocol. The Kyoto Protocol is a treaty adopted in 1997 by developed countries in which member states committed themselves to a total 80% reduction of three of the most dangerous greenhouse gases causing global warming (carbon dioxide, methane, nitrous oxide) produced by them by 2050 at the latest, compared to their annual emissions in the base year 1990. The goal of the treaty is to achieve the stabilization of greenhouse gas concentrations in the atmosphere in order to mitigate the predictable effects of climate change and global warming.

The treaty entered into force in 2005 and within one and a half years 169 countries signed and ratified the protocol.

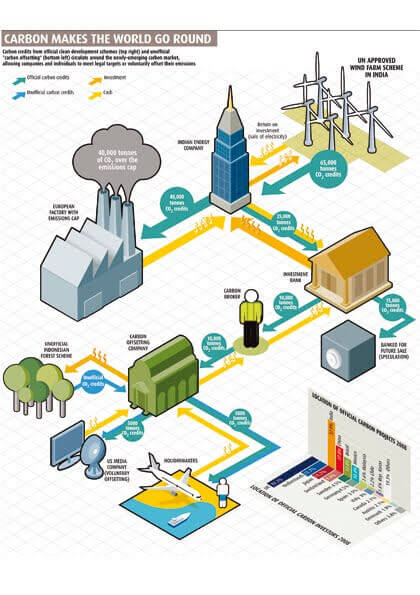

Under the Kyoto Protocol, each member state has a greenhouse gas emission quota. The countries that have exceeded their emission quotas can purchase quotas from those that have not used up theirs. These quotas are also called “compliance market carbon credits.”

Through compliance market carbon credits, member states operate an international emission control system, the purpose of which is to mitigate greenhouse gas emissions on a national level. The system, however, is insufficient in that it does not offer a real alternative which could eliminate high-GHG emission human activities.

Voluntary Carbon Credits

In contrast to compliance market quotas, voluntary carbon credits are generated as a result of actual emission reduction. They are created either through certified projects now using renewable energy that have used fossil fuel earlier, or through initiatives that were specially designed for producing clean energy. And from any project that can be scientifically demonstrated to contribute to climate change mitigation and the Sustainable Development Goals (SDGs).

Owing to the emergence of the voluntary market, not only businesses with significant greenhouse gas emissions, such as large companies and factories, have the opportunity to take responsibility for the environment but also small and medium-sized businesses as well as individuals can do so. The income from carbon credit sales – the price of carbon credits – supports innovation in the field of utilizing renewable energy sources.

Voluntary carbon trading has a direct and positive impact on sustainability.

When you buy carbon credits, in fact you give financial support to a project that is producing renewable energy. This is because carbon credits are generated through green projects and, in the sales process, part of the money ultimately goes to that project. Therefore, though buying carbon credits does not lower your own emissions, you can still have a positive influence on our global environment.

When buying carbon credits, it is important to make sure they come from a source which is both verified and certified. Only then can you be certain that the income is indeed spent on supporting projects devoted to renewable energy.

Generating Carbon Offsets

There are various types of projects that generate voluntary carbon credits. These actually help to significantly reduce GHG emissions, or eliminate them altogether. Wind power, solar power, hydroelectric power are just a few of them. Afforestation is also worth mentioning.

These projects are required to meet very strict criteria in order to be able to generate carbon credits after a certain period of time. The most important one is additionality, which means that a project is entitled to generate carbon offset credits only if it can be proven beyond doubt that it would never have occurred without the investment raised by selling carbon offset credits.

Registry

Like other instruments having a specific value, carbon credits are entered into registries which are strictly monitored and supervised. Each credit must show the following data:

•Source

•Owner

•Unique serial number

•Type (what kind of project generated it, e.g. wind farm or hydroelectric power plant)

•Standard (the most widely recognized standards are the VCS and the Gold Standard)

•Certification (independent organizations)

The registration of carbon credits, both those in circulation and those retired, is carried out by independent organizations, called registries. These independent registration organizations handle carbon credit data in a way that is publicly available and thus open to everybody.

Using and Retiring Carbon Credits

Every time you wish to offset one tone of your greenhouse gas emissions, you have to start a retirement procedure using the services of an independent registration organization with regard to one of the carbon credits in your possession. Retirement is the final stage of the lifecycle of carbon credits since afterwards they can no longer be used in commerce. In fact, carbon credits are “born to be retired.”

The power of voluntary carbon credit trading is that it is profitable to all participants in the market. It keeps the money flowing to green projects, which is why they are always interested in generating more and more carbon credits. At the same time, buying and retiring carbon credits have a PR value for companies as it shows to the general public that they consider sustainable development extremely important. And finally, carbon credit trading contributes to slowing down global warming, which is in the interest of each and every one of us.